NFTs provide an immutable record of ownership for digital assets, verified by the global Ethereum Blockchain. The Blockchain tracks ownership of NFTs until the end of human civilization.

2021 ushered in speculative mania in every conceivable investment and collecting category. Real Estate, Stocks, Precious Metals, Comic Books, Pokemon Cards, Graded Video games and Crypto Currency hit all time highs (ATH), with some hitting a new ATH on a weekly basis. Investors, bored from government imposed house arrest had more time and money (due to stimulus checks or lack of commuting fees) to gamble in high risk money plays.

Hungry for new bets, these investors gravitated to Non Fungible Tokens (NFT), a new, exciting investment vehicle. The NFT space captured the public imagination in February, driving prices and participation upwards in an asymptotic trajectory.

Hackneyed critics quickly lobbed the knee-jerk tulip mania cliché at NFTs, in an attempt to discredit their investment value. Do these unimaginative accusations have merit? In this blog post I will investigate the value proposition of NFTs and help you decide for yourself.

DISCLAIMER: I base the information on this blog on my personal opinion and experience and you MUST not consider this professional financial investment advice. Do not ever use my opinions without first assessing your own personal and financial and situation and you MUST consult a financial professional before making any investment. Keep in mind I will change my thoughts and opinions over time as I learn and accumulate more knowledge. I am NOT a financial professional! This blog is not a place for the giving or receiving financial advice, advice concerning investment decisions or tax or legal advice.

The Value Props

Value Prop #1: The Blessing

Dim experts will point out a (perceived) shortcoming of NFTs: the ability for anyone to save a local copy. Consider, for example, a token encoded in JPEG format. A web surfer (90s slang) could buy the NFT for Ethereum, and own the JPEG. Another web surfer, can also right click on the JPEG and save the JPEG to her desktop. Both the purchaser and the downloader will have the SAME EXACT JPEG.

Try it for yourself. Open this link in another tab to find an Isometric Pixel Art NFT that tokenizes a PNG of a leaning bookcase. You can either buy the NFT for 0.01 ETH, or just download the PNG for free.

Given that, why would anyone pay valuable (well, this week at least) Ethereum for the PNG when he could download the PNG for free?

I will answer that question after a discussion about Bananas and Dots.

Bananas

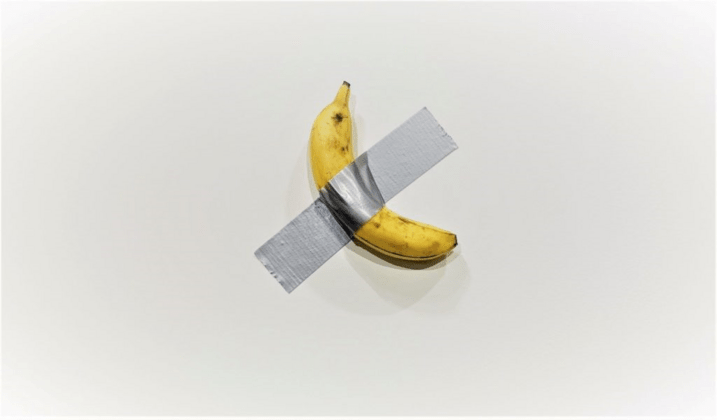

The Artist Maurizio Cattelan duct taped a banana to a wall, called the result a piece of art (Comedian) and then promptly sold two editions at Perrotin, the Gallery for $120,000 each.

Each edition comes with a Banana, a piece of duct tape, a certificate of authenticity (COA) and an instruction manual. If the banana rots, the manual instructs the owner to replace the banana with a new one, available at her local grocery store. If the duct tape loses stick, the manual instructs the owner to buy a new roll of Duct tape from a hardware store, cut a new piece, and replace the old piece.

After about a year, I would expect the owner to be on their tenth banana, and tenth piece of Duct tape. In other words, any person on the planet could buy a banana and a roll of duct tape and have a near-exact copy of the $120,000 installation in their home.

Why would anyone buy Comedian, then, if it just uses a commodity banana and a commodity piece of duct tape?

Emmanuel Perrotin, owner of Perrotin, the Gallery says "All artwork costs a lot of money, [collectors] buy an idea, they buy a certificate."

In other words, the collector buys Commedian for the COA, or more specifically, the Artist's blessing. In the same vein, a collector buys an NFT for the digital signature, which represents the Artist's blessing.

NOTE: Cattelan released a third edition of Comedian and Perrotin expects the sale to close at $150,000.

Circles Art

Damien Hirst released a thousand or so paintings of dots (yes, just dots). He did not paint these paintings, he hired someone else to paint them for him, and then he signed them.

Business Insider writes:

There are nearly 1,400 of Damien Hirst’s spot paintings in existence. The artist has only painted around 25 of them himself. So who made the other 1,340 or so paintings, which regularly sell for tens of thousands of dollars? They were done by Hirst's coterie of assistants — a well-known fact.

You could hypothetically wait outside of Hirst's studio, accost one of his hired guns and offer them a couple of hundred bucks to paint dots for you. This same artist just painted a dozen or so dots paintings for Hirst. You could have the SAME artist, using the SAME paints paint the SAME dots on the SAME canvas for a fraction of the price. Your version, however, would have zero value, because you would not get Hirst's autograph.

Back to Business Insider:

[Hirst] told Reuters last year that every single spot painting contains my eye, my hand, and my heart. And they all contain his signature.

The home-made comedian or assistant painted dots pieces represent 1:1 equivalents of the official releases, just like a Save Copy As represents a 1:1 representation of a JPEG NFT. The substitutes, while physically identical lack the Artists' blessing, and have no value.

The digital signature represents the Artist's blessing for digital pieces.

Value Prop 2: Investment

At present time, NFTs hold their value in Ethereum. Ethereum swings high and low, and the NFT market price holds steady.

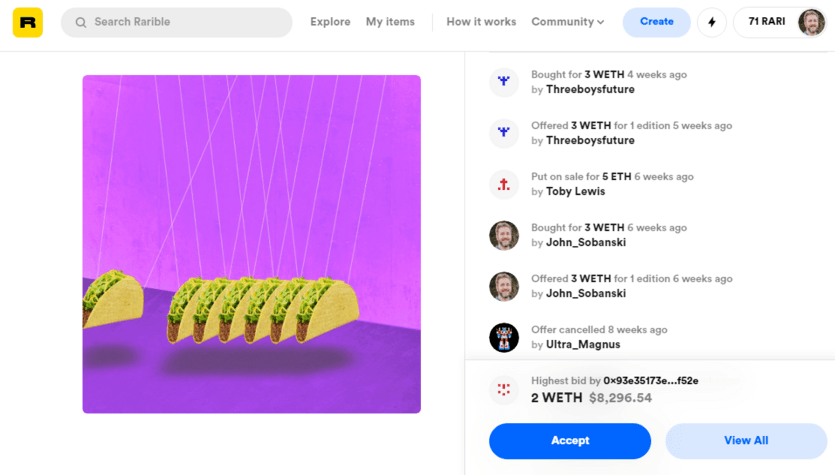

I purchased a Taco Bell NFT in March for 3 ETH, with Ethereum at $1.8k/ ETH. Another copy sold for 3 ETH in April with Ethereum at $2.3k/ ETH. On May 9th, someone made an offer for 2 ETH with ETH at $4k/ coin. In terms of dollar value, the May bid landed at 43% higher than my initial purchase, with no sellers willing to part.

We set the floor at 3 ETH.

The following table captures the transaction

| Date | USD/ETH | BID (USD) | BID (ETH) | SALE (ETH) |

|---|---|---|---|---|

| March 30th, 2021 | 1,819.47 | 5458.41 | 3 | 3 |

| April 14th, 2021 | 2,299.35 | 6898.05 | 3 | 3 |

| May 9th, 2021 | 3,911.46 | 7822.92 | 2 | NONE |

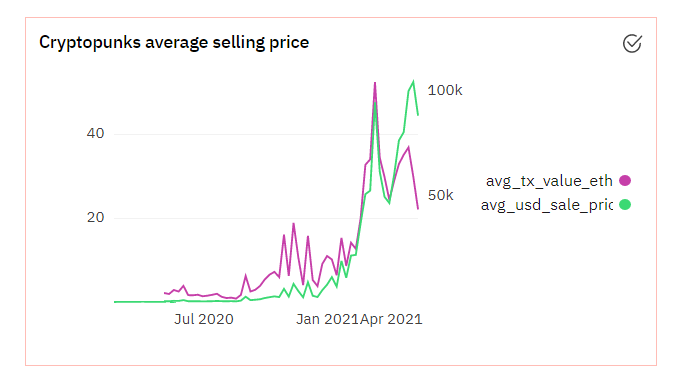

Crypto punks, the NFT gold standard followed the same trend, until early May. Larvae Labs released Meeple, which current Crypto punks owners unlocked from their token. This added confusion to the market, since not all owners unlocked their Meeple, and an unlocked Crypto Punks token realized lower value than a locked Crypto Punks token.

The following chart captures recent Crypto Punks sales.

Value Prop 3: Durability

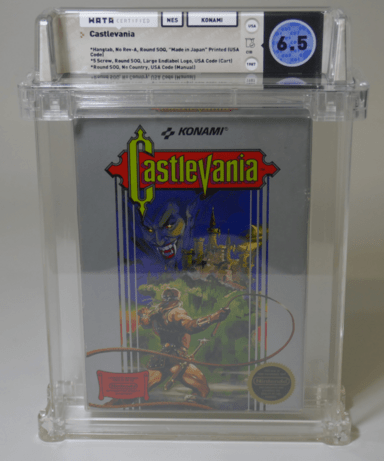

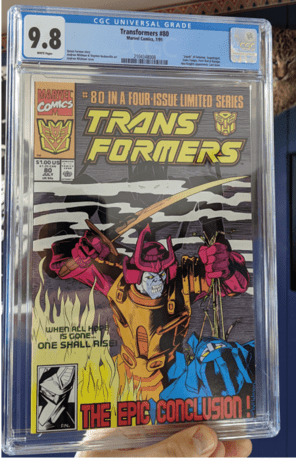

I own Video Games Authority (VGA) graded video games, Wata graded video games, and Certified Guarantee Company (CGC) graded comic books.

I sent my comic and video game collections from the 80s and 90s in to get graded early last year, and the grading increased their resale value significantly.

I plan to unload these collectibles, however, since I need to pay attention to humidity and temperature when storing them. Too much humidity will irreversibly wrinkle the pages, despite the hermetic seals. In the mean time, I need to insure my investment or rent a (climate controlled) safe deposit box to store the items. A simple Home owners' policy won't suffice, I'll need to get special insurance to properly cover the collectibles.

In other words, physical collectibles yield a logistical headache. With an NFT, I just need to protect my seed phrase. The blockchain will ensure that my collectible stays in mint, case fresh (nerd lingo) condition until the end of time.

Downsides

Now that I have discussed the value proposition of NFTs, I will now pivot to discussing some of the downsides (skipping the obvious downside associated with investing in a new, insanely speculative collectible category).

Downside 1: Security

I have about 5 ETH worth of NFTs. In mid may, Ethereum hit $4.4k/ token. At that point, I had a collection of NFTs valued at over $20,000.

A Crypto Punk starts at 20 ETH, worth over $80,000 during that same time period.

I protect my NFTs by hand writing my seed phrase (never stored on-line or on any computer) and putting that seed phrase in my out of state (not saying which one) safe deposit box. All NFT collectors must be equally paranoid. If they take a picture of their seed phrase with an iPhone, for example, they will lose all of their NFTs at the next iCloud hack.

Once you lose an NFT, you will never recover it.

Minting NFTs provides an interesting security situation as well. We all heard that Beeple (Not Meeple) sold an NFT for over $60,000,000. He created a piece of digital art, used his private key to sign it, and then had Sotheby's sell the NFT. Some lucky collector now owns that NFT.

What happens if a hacker steals Beeple's private key? The collector will still own his NFT, and the NFT will be secure. But now, a hacker will own Beeple's digital signature, and could create new NFT and sign the new pieces. The new pieces will have the same digital signature as the $60,000,000 original.

At that price point, of course, buyers would do due diligence, look to the Blockchain ledger and say only signatures before the hack have validity, but it still leaves a bad smell on the entire situation. Collectors would have to include human auditing into the once pure, mathematical Blockchain equation.

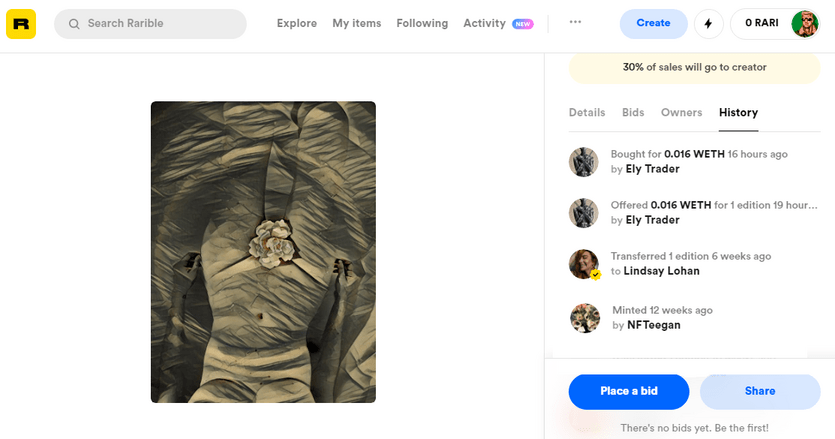

Consider this on a smaller scale, where an indie artist gets verified on Rarible. If the Artist compromises her key, it would nullify all art work post-hack.

She would have to go through the Rarible verification process once more, and alert buyers to the fact that she has two accounts (two signatures), one for pre-hack and one for post hack. This fact would inject confusion into the collecting process.

Downside 2: Gas

NFTs ride the Ethereum blockchain.

An Artist must pay a fee to mint, auction or sell their NFT. A buyer must pay a fee to bid on a piece or buy a piece. The Ethereum standard calls this fee "gas."

From experience, I have paid $60-$80 to mint an NFT. I paid $40 to bid on an NFT. An indie artist may place an NFT for sale for $3, for example, but the buyer will have to pay over ten times that in order to cover gas.

Gas introduces friction into the NFT minting and transaction process, and disproportionately affects small scale artists.

Downside 3: Winner Take All

Right now, Crypto Punks, Celebrities and Brands own the NFT space.

YouTube stars, professional athletes, musicians, reality TV stars and fast food chains muscle out the smaller indie artists.

In 2018 the Cryptocurrency market crashed hard, and obliterated most of the alt coins.

I personally lost 99% of my investment in coins such as BitGreen, Vertcoin, Electroneum and Byteball.

The major players, Bitcoin, Ethereum, Monero and Litecoin emerged from the crash and hit all time highs several years later. I do not see why NFTs would not follow this same playbook, where the top 1% of the NFTs will hold long term value whereas the rest could plummet in price to pennies.

What's Next

In this concluding section, I will discuss some interesting ideas around the NFT space that may materialize in the near or distant future.

Pedigree

The Blockchain tracks the entire chain of ownership for a given NFT, the provenance if you will.

When you own an NFT, collectors will see everyone who owned that NFT. Given that, would an NFT once owned by Elon Musk or Skeet Ulrich (I've lost track of pop culture this decade) be more valuable than one owned by an anonymous non-celebrity? I don't see why not. Perhaps celebrity ownership will increase the value of certain tokens.

Lindsay Lohan, for example, owned this token at one point, and you can see her Avatar in the token's history.

Donations

I would love to see some of my favorite non profits, such as the Ronald McDonald House of Baltimore set up a digital NFT wallet. NFT collectors would then transfer tokens to the wallet, and the Charity would sell them for a profit. This seems like a straight forward process. The Charity would have to spend time accounting the NFT ownership and sales for tax purposes, but other than that, I think it would be a huge win for the non-profit space.

Deep Freeze

I will now revisit a common complaint about NFTs: anyone can download a local copy of the artwork. In reality, NFTs live on computers and developers can program computers to wrangle bits as they see fit. In theory, a company could develop a service to prevent people from saving a local copy of a digital collectible. A company could also develop a service to prevent them from snapping a picture with their cell phone.

In 2021 I can watch the entire lineup of TGIF from 1987 anywhere on the planet using my cellphone, so anything is possible!

One such company, Darkblock promises to prevent the issue with local downloads.

From their website:

Darkblock enables managed display rights for your rare NFTs. With Darkblock, “limited edition” artwork now holds the same meaning in the digital space as it does in the physical world. Our encryption technology allows digital artists to control access to their original works, so they can finally push one-of-a-kind, protected, hi-res content into the NFT space.

For collectors, that means true singularity in what you own, higher resolutions, and 100% exclusive possession of your art assets — so that the art file on display is as valuable as the certificate of ownership behind it.

I look forward to seeing what Darkblock delivers in the near future.

Identity

In conclusion, I will revisit the idea of managing verified NFT creators in the face of compromised keys. Verification, in general, requires a service to map a persons identity to a private key.

We verify ourselves online in several different ways:

- A selfie

- A scan of our driver's license

- An uploaded bank statement

- Link our credit profile from Experian

A company could provide a service to map our physical identity using traditional identity documents to a private key, or better yet a set of private keys, with lifecycle management to retire compromised keys. Bloom provides this service, so to me it appears to be a natural fit for the NFT space.

Thank you for reading and please leave your comments below!